Money causes a lot of stress in everyday life. Some people are constantly thinking about where to earn more; others try to spend less. In both cases, we face anxiety and discomfort. To a certain extent, it's a normal protective mechanism making us more careful and prudent. But sometimes, we can feel trapped in a no-way-out situation.

First, relax a little. You may not know, but now you can receive personal loans being in any situation. It means that you always have a backup plan for the case of an emergency. So, stop worrying about lack of money and read this article with useful tips on reducing stress and its effect on your life.

Top 3 Effects of Financial Stress

This phenomenon is not that harmless as you may think. In fact, it has multiple negative effects in different life areas.

1. It ruins relationships. According to the statistical data, in 2021, financial problems were the cause of over 36% of all divorces and became the fifth most common reason. It's easy to understand; hardly anyone can enjoy life and be happy experiencing serious issues in financial life. The accumulated stress and frustration lead to frequent quarrels and home fights.

2. It ruins health. Financial instability and stress lead to physical and mental difficulties. People in distress show higher blood pressure and poor heart health. They also tend to delay asking for medical help and can't afford some treatments. The mental state suffers too. Continuous money issues cause depression and other negative mental states.

3. It ruins self-confidence. Inability to get out of the debt trap or solve financial issues hurts our confidence and self-esteem. It can lead to a psychological phenomenon called learned helplessness. It means that the person doesn't believe in their ability to make things better and doesn't even try.

These disastrous effects of the stress caused by the money squeeze show that you should take them seriously and take all possible measures to reduce the experienced stress.

10 Proven Tips on How to Reduce Financial Stress and Burden

With a certain amount of effort, you can change your life in order to minimize the stress you face. We compiled the list of proven and effective recommendations.

#1 Study the Enemy

First, you should know the enemy. Determine the situations and issues that are making you nervous. It can be monthly loan payments, credit card debt, or mortgage installments. Make a list of reasons preventing you from feeling confident. This list will help you in your further journey.

#2 Start Budgeting

The importance of a proper budget is so huge. It's surprising that not everyone uses this useful tool. Now, when you know your biggest issues, you can learn more about zero based budgeting or adapt the budget the right way. For example, let's assume you are worried about your debt. The funding will help to determine the methods of quicker repayment. When you see the whole picture, it's easy to create a strategy. But budgeting is not that easy for the newbie. That's why you should take baby steps. Start with dividing your net income into three parts: 50% for necessary expenses, 30% for your wants and pleasures, and 20% for saving. Also, start tracking your expenditures; it will give useful information on the ways of reducing spending.

#3 Learn the Difference between Wants and Needs

After tracking spending for some time, you'll receive a picture of your spending patterns. Analyze each point separately. Do you spend money on necessary things or tend to indulge every desire? If it's hard for you to cut off all the expensive wants, try to replace them with cheaper ones. Some expenditures may seem stupid after some time, and you can easily get rid of them.

#4 Save for Emergency

An emergency fund guarantees that you can withstand difficult situations in the future. This is the insurance and a source of confidence. Make sure that you put away a certain sum in a separate account every month and don't use this money. Now, when you have mastered the art of budgeting, you know how much you can save monthly without creating additional financial stress.

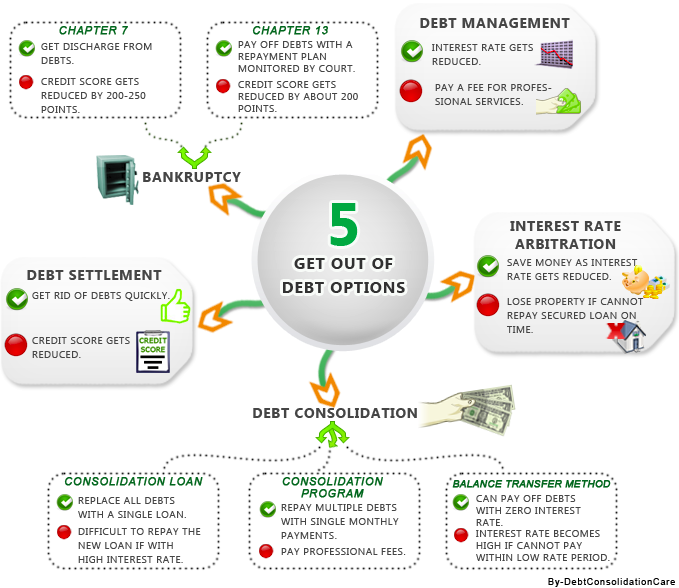

#5 Think of Debt Reducing

Life without debt is wonderful and pleasant, so reducing the amount of debt you have is one of the primary goals. Once again, study your budget and think of possibilities. Maybe your income allows doubling of the monthly payment; perhaps you'll have to search for additional earnings. In any case, develop a tactic and follow it. Believe us, getting rid of the debt is worth the effort.

#6 Search for Help

Don't be afraid to ask for help if you keep struggling. You can address your relatives and friends or ask the bank about repayment holidays. Possibly you have a right to social benefits of some kind, check the information about social programs in your region. Psychological help is important too; find a specialist if you have lost motivation and inner strength.

#7 Educate Yourself

Find useful information about money management, learn how to use modern programs and financial tools. In our world, information is power, don't miss opportunities to raise your literacy. New knowledge will open new perspectives for your financial state improvement.

#8 Accept What You Can't Control

You can't change everything that causes your stress. For example, if you are worried about the perspectives in the pandemic situation, you can control the perspectives but have no power over the pandemic. Stop worrying about the things you can't change by concentration on the tasks at hand.

#9 Find Additional Income Source

We all have multiple opportunities; try to see them. Evaluate your skills and find a way to earn more. Maybe you can be a tutor and help students; maybe you are good at web design and can make sites for sale. The truth is, only you can determine the best side job for your situation.

#10 Track the Progress

The monthly budget will show your income/spending ratio, and the progress you've made after the implementation of these riles into your life. Don't expect great results after a month; even a tiny improvement is something to be proud of.

In any case, these recommendations will work if you are honest with yourself. Stop sweeping the problems under the carpet and face them. Now you are ready for the journey to a life free of stress and anxiety.

COMMENTS